HELPING YOU MAKE YOUR LIFE PLAN A REALITY

Many folks view the financial planning process as creating a budget, crunching numbers and reviewing a bunch of charts and tables. No wonder some people avoid beginning the process! Fortunately, there’s a better approach: Life-Centered Planning, that begins by talking about you, not your money.

My job as a Life-Centered Planner is to build a financial plan that will help you make your life plan a reality. But I believe that maximizing your Return on Life is just as important, if not more so.

I invite you to take our complimentary Return on Life Assessment to understand how well you are using your wealth to improve your life. Then, I invite you to get in touch for a complimentary visit to discuss how we can help you bring your vision of success into reality. To learn more about maximizing your Return on Life, check out the educational articles below and on our company website.

MEET ERIC

Wealth Impact Advisors

Masters of Business Administration

CFP® Certified Financial Planner™

CKA® Certified Kingdom Advisor

GET IN TOUCH

please call or email me at:

ecoffman@teamwia.com

(330) 865-3545

RETURN ON LIFE

FOOD FOR THOUGHT

DOES A ROTH CONVERSION MAKE SENSE FOR YOU?

A RECOVERY 9‐POINT FINANCIAL CHECK-UP

The personal toll of the COVID crisis has been devastating for some but significant for each of us. Our financial lives may also have been negatively impacted by the loss of jobs, income, and a steep drop in the stock market. Some timely planning opportunities exist, however, due to historically low interest rates, new legislation and relatively low income tax rates. Therefore, it is an ideal time for a financial check-up to assess any damage and consider planning opportunities that may lead to more wealth creation over the long run.

SIX WAYS TO REDUCE FUTURE INCOME TAXES TODAY

Now that you’ve experienced two years under the new tax regs you may be interested in finetuning your income tax planning for 2020. Here are six tax-savvy steps you can take to reduce your future income taxes, including Expense Bunching, Asset Positioning, Tax-Loss Harvesting, Minimizing Pre-Tax Retirement Plan Contributions, Qualified Charitable Distributions, and Donor Advised Funds.

Making Your Life Plan A Reality

THE STRETCH IRA IS NO MORE

WILL THIS BE THE YEAR YOU FINALLY…

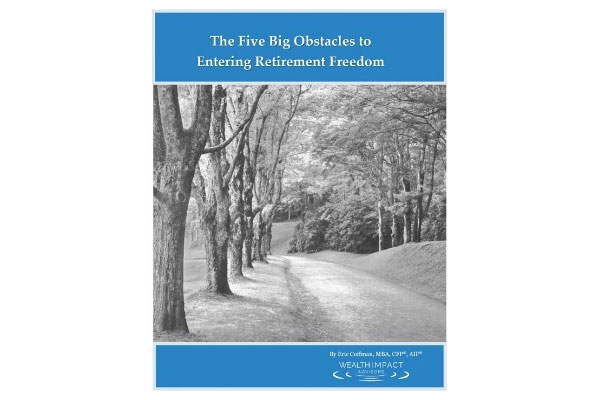

SPECIAL REPORT: THE FIVE BIG OBSTACLES TO ENTERING RETIREMENT FREEDOM

We all want to experience more peace, freedom and impact in our lives. After all, do we really need more anxiety, confusion, fear and inflexibility? The purpose of this Special Report is to help you identify the obstacles in your life that hold you back from experiencing more financial peace, freedom and impact – and consequently, from having clarity and confidence about your retirement future. In the process it is our desire that you will bid adieu to financial worry, confusion and fear.

ERIC COFFMAN

MBA, CFP®, CKA®

Wealth Impact Advisors, LLC

ecoffman@teamwia.com

33 Merz Blvd Suite 100

Fairlawn, OH 44333

P: 330.865.3545

F: 330.319.8959